Sailing Into Success: Opening the Potential of Offshore Count On Solutions for International Wide Range Preservation

The Advantages of Offshore Trust Services for Wide Range Preservation

You'll be astonished at the advantages of overseas count on solutions for riches preservation. Offshore trust services offer a variety of benefits that can help you safeguard your possessions and guarantee their long-lasting growth. One of the essential benefits is the ability to secure your riches from lawful cases and possible financial institutions. By placing your assets in an offshore trust fund, you develop a legal obstacle that makes it difficult for others to access your wealth. This is specifically valuable if you reside in a country with an unstable political or financial environment.

Another advantage of overseas trust fund solutions is the potential for tax obligation optimization. Lots of overseas jurisdictions use positive tax regulations and motivations that can assist you decrease your tax obligation responsibility. By utilizing these solutions, you can legitimately lower your tax worry and optimize your wide range buildup.

In addition, offshore depend on services supply a greater level of privacy and discretion. Unlike in onshore territories, where financial details might be quickly available, overseas trust funds offer a better level of anonymity. If you value your personal privacy and want to maintain your financial events discreet., this can be particularly appealing.

Furthermore, overseas count on solutions provide flexibility and control over your possessions. You can pick the terms and conditions of the depend on, define how it needs to be handled, and also establish when and just how your recipients can access the funds. This degree of control permits you to tailor the count on to your specific needs and goals.

Comprehending the Lawful Framework of Offshore Trust Funds

Understanding the lawful framework of offshore trust funds can be complicated, yet it's vital for individuals seeking to maintain their riches - offshore trustee. When it involves offshore trusts, it is very important to understand that they are governed by particular regulations and regulations, which differ from territory to jurisdiction. These legal frameworks establish just how the depends on are established, handled, and strained

One key facet to take into consideration is the selection of the territory for your offshore count on. Each territory has its very own collection of policies and legislations, and some may provide more desirable problems for wealth preservation. You'll require to examine factors such as the stability of the legal system, the level of confidentiality offered, and the tax implications before making a choice.

Once you have actually picked a territory, it's crucial to comprehend the lawful needs for establishing and keeping an overseas count on. This includes abiding with reporting obligations, making certain correct documentation, and adhering to any type of constraints or constraints imposed by the jurisdiction. Failure to meet these demands can result in lawful and financial repercussions.

Trick Factors To Consider for Picking an Offshore Depend On Territory

When making a decision on an overseas depend on territory, it is very important to thoroughly think about elements such as the territory's lawful stability, degree of discretion, and tax obligation ramifications. These essential considerations will certainly make sure that you make an informed choice that aligns with your wealth conservation goals. To start with, lawful security is vital as it supplies a strong foundation for the trust's procedure and security of your possessions. You want a territory that has a reputable lawful system and a background of valuing residential property rights. Confidentiality plays an essential function in offshore trust fund planning. You require a jurisdiction that promotes and values customer personal privacy, providing durable actions to secure your personal and monetary information. This will make certain that your wealth remains secured and your affairs remain personal. Finally, tax ramifications can not be overlooked. Different territories have differing tax programs, and you ought to examine the influence on your trust fund's assets and income. Choosing a jurisdiction with favorable tax legislations can help maximize the advantages of your offshore trust. By carefully thinking about these factors, you can select an overseas count on jurisdiction that fits your demands and offers the essential degree of defense for your riches.

Making Best Use Of Property Defense Through Offshore Trust Structures

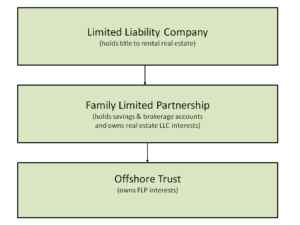

Optimizing property defense can be accomplished via offshore trust fund structures that offer a personal and safe and secure environment for protecting your wide range. By utilizing overseas trust funds, you can guard your assets against potential legal cases and guarantee their long-term conservation.

Offshore trust fund frameworks use a series of benefits that can help safeguard your properties. One check these guys out crucial advantage is the capacity to develop depends on in territories with strong lawful frameworks and robust try this web-site possession protection laws. These jurisdictions are frequently distinguished for their dedication to confidentiality, making it difficult for plaintiffs or lenders to gain access to info concerning your trust or its assets.

Furthermore, offshore trusts provide a layer of anonymity. By placing your possessions in a depend on, you can keep a particular degree of privacy, shielding them from undesirable focus or examination. This can be specifically advantageous for high-net-worth individuals or those in delicate occupations.

Along with possession protection, offshore trust fund frameworks supply tax obligation advantages. Some territories impose little to no tax on income generated within the trust fund, permitting your wealth to grow and intensify with time. This can result in substantial tax financial savings and raised wide range conservation.

Overall, overseas trust fund frameworks provide a private and protected atmosphere for preserving your wealth. By making best use of possession defense via these structures, you can make certain the lasting conservation and growth of your possessions, while enjoying the advantages of privacy and tax obligation benefits.

Discovering Tax Obligation Benefits and Compliance Needs of Offshore Trusts

Exploring the tax obligation advantages and compliance requirements of overseas trusts can provide valuable insights into the financial benefits and legal responsibilities linked with these frameworks. Offshore trust funds are often located in jurisdictions that offer positive tax regimes, such as low or absolutely no tax on trust revenue and funding gains. By putting your assets in an offshore count on, you can legally lessen your tax liability and maximize your wide range preservation.

Conclusion

So there you have it - the possibility of offshore trust services for worldwide wealth preservation is enormous. Additionally, exploring the tax advantages and conformity demands of overseas trusts can even more boost your wide range preservation approaches.

When making a decision on an overseas trust fund jurisdiction, it's essential to meticulously consider factors such as the territory's legal security, degree of confidentiality, and tax ramifications. By meticulously considering these factors, you can pick an offshore trust fund territory that matches your requirements and supplies the essential level of check security for your riches.

Offshore depends on are commonly located in territories that supply beneficial tax obligation regimes, such as low or zero taxation on trust revenue and capital gains - offshore trustee. By putting your possessions in an overseas count on, you can legitimately minimize your tax responsibility and optimize your wealth preservation. In addition, discovering the tax benefits and conformity requirements of overseas trust funds can further improve your wide range preservation approaches